Features

The price is tight

Navigating cost and pricing’s new normal

October 17, 2023 By Jack Burton

Despite a surge in project demand, issues with the supply chain, material access, and labour woes across the industry have put a strain on cost of doing business. Photo: Andrey Popov/ Adobe Stock

Despite a surge in project demand, issues with the supply chain, material access, and labour woes across the industry have put a strain on cost of doing business. Photo: Andrey Popov/ Adobe Stock Although historic commitments to infrastructure investments and highway overhauls nation-wide may make it seem like there’s plenty of money to be made, rising prices across the roadbuilding and heavy construction industries have made this year anything but a gold rush.

While inflation recovery efforts, including interest rate increases from the Bank of Canada, have had some impact on the market, recent studies show materials costs are still a concern across the industry.

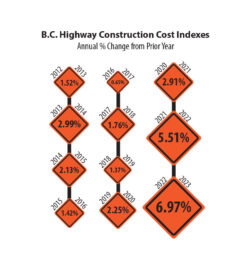

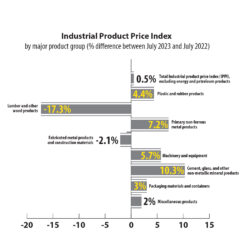

A report from the Government of British Columbia showed the province’s highway construction costs have increased by nearly seven per cent from 2022 to 2023, the highest in a decade by a wide margin, with Statistics Canada’s Industrial Products Price Index (IPPI) revealing year-over-year price increases in essential materials including asphalt, cement, and diesel fuels.

The current state of pricing in the heavy construction and construction materials sectors is not a one-factor issue. John Marsicano, senior director at WLW Construction Consulting, says the number of knots that still require untying in the Canadian and global marketplaces is a sign that stabilization is still some time away.

“There’s definitely more volatility for this industry right now in as long as I can remember,” Marsicano said.

“I think people need to keep sight of the fact that the current pricing situation is a result of many things, such as the changing global philosophy on carbon emissions, the manufacturing of parts, and labour supply. Until we can get a handle on those globally, I think we’re going to have this situation for a couple of years

to come.”

Making room for the boom

Though a range of factors are currently adding weight to the scale, Marsicano views the COVID-19 pandemic and the period of disruption it caused to both supply chains and labour operations as an amplifier of cost burdens already felt by the industry.

“Pricewise, everything was already in kind of a boom prior to COVID, and I think that when the pandemic shut everything down, that kind of exacerbated it all,” Marsicano said. “Labour restrictions meant that you had equipment that wasn’t running, and all of a sudden, you couldn’t back up those costs with production.”

“Pricewise, everything was already in kind of a boom prior to COVID, and I think that when the pandemic shut everything down, that kind of exacerbated it all,” Marsicano said. “Labour restrictions meant that you had equipment that wasn’t running, and all of a sudden, you couldn’t back up those costs with production.”

A different kind of boom has occurred in the years following the pandemic’s disruptions, with a need for new housing starts and a sharp increase in infrastructure initiatives and heavy construction projects moving forward across Canada and the U.S. This surge in demand has only put further strain on the availability of materials and equipment, and in turn, the cost of doing business.

“As long as the construction boom continues — and I’ve seen this from the clients I deal with — it doesn’t seem like costs are slowing down, especially since the scale of many of these jobs is significantly larger than they were pre-COVID,” said Marsicano.

Current market conditions and prices make it difficult for this project surplus to be taken advantage of, with the nature of these costs also limiting the ability to take these contracts on in the first place. With factors like ongoing supply chain issues and labour shortages, it’s not only the money, but the necessary equipment and personnel that are in short supply, making it hard to commit to completing jobs.

“A handful of clients are in the same boat, where they had equipment issues, and it ends up that it’s quicker to get a new piece of equipment altogether than to get the replacement parts,” said Marsicano. “Another one of the largest issues is that we don’t have enough labour to fill these open slots. There are not enough people that want to do this type of work, so there’s more work than we have resources.”

Marsicano highlighted a need for the industry to think outside of the box, urging contractors to re-evaluate and streamline their processes in adapting to this volatility where they can.

One area he believes the roadbuilding industry can adapt and take advantage of new technologies, is in their usage of alternative and recycled materials.

“That’s one way for roadbuilders to get out of this, is to rethink of ways to use the material, whether that’s alternatives such as recycled materials or a mixture of that with your standard ones,” he said. “It’s about figuring out how you switch gears.”

Material concerns

This need to adopt new perspectives on construction materials extends beyond what’s in the mix. Access to these materials, specifically in Canada, plays a pivotal role in pricing, according to Jason J. Annibale, partner and national co-chair of construction at McMillan LLP.

“For the pricing of materials, the big issue is that it’s all based on source and access. If getting access to these materials and their timely transportation poses a problem, then there’s going to be disruption and price increases,” Annibale said. “In Canada, we’re a large country, so proximity to materials is going to be an issue.”

“For the pricing of materials, the big issue is that it’s all based on source and access. If getting access to these materials and their timely transportation poses a problem, then there’s going to be disruption and price increases,” Annibale said. “In Canada, we’re a large country, so proximity to materials is going to be an issue.”

Market proximity is a major contributor to Canada’s current state of construction pricing, according to Annibale, and its role in this issue has bottom-line implications that impact more than just cost-per-ton and getting shovels in the ground.

“Keeping supply chains local reduces the risk of their disruption and reduces carbon footprint, which is equally as positive,” said Annibale. “The high cost of energy and transportation that we have seen over the last few years, inflation, and high interest rates, these are all interconnected factors that pose challenges to construction and set the stage for what we now see in the sector.”

The awarding of procurement points for contractors making use of local workers and materials is just one of a number of potential solutions and incentives introduced to encourage accessible supply chains in roadbuilding and infrastructure construction, according to Annibale.

Another strategy gaining traction for addressing price fluctuations during bidding processes are changes to the terms of the contracts themselves.

In recent years, contractors have aimed to mitigate the risks stemming from increasing costs, supply chain issues and shortages by proposing alternative materials or including price fluctuation clauses in their bid.

“Price escalation or fluctuation clauses are increasingly being used within contracts,” Annibale said. “With the volatility we’ve seen, there’s a recognition in contracts of that volatility, and they are providing for changes, either through specific product substitution or by attaching clauses to the terms of the contract.”

The dotted bottom line

This trend toward contracts that account for fluctuations in pricing and their impact on project delivery has also been noticed by Andrea Lee, partner at Glaholt Bowles LLP, who sees this model as having particular value for the roadbuilding sector.

“The industry at large is already adopting these price escalation clauses, and in roadbuilding, a lot of the contracts are based on unit prices,” said Lee. “So, to the extent that materials and rates continue to increase, if there is a limited form of relief for those unit rates, I think we might start to see more of its inclusion in roadbuilding contracts.”

Lee also shared that over the last several years, most of the contracts she now encounters in her work are built on the Canadian Construction Documents Committee’s cost-plus model; a model that allows contrators to recover the costs of materials, in addition to billing a set fee for time. Those with more flexible pricing options such as the the CCDC5-B contract, are shift away from the standard fixed cost contract type of the CCDC-2.

“I would say within the past few years, most of the contracts that I deal with now are CCDC 5-B,” said Lee.

“That can have a variety of options for what the parties want to come up with in terms of pricing the work, but what I’m seeing in contracts is, for the most part, that parties are agreeing to essentially be more transparent on costs.”

This emerging new standard, Lee said, is a necessity for protecting contractors in an industry climate where not only project costs, but the processes and timelines involved are anything but guaranteed.

“I would say that the number of change requests and change orders on projects that I’ve been seeing are likely higher as a result of the volatility [in prices],” said Lee.

“For contractors, in order to recover from pricing changes, there has to be an actual change in the work — not just on the issue of cost, but also, for example, design changes to the work around material availability or the timeline of the project.”

Breaking the middle ground

Despite the rising value of provisional measures like price escalation clauses and cost-plus contracts, the reality of pricing instability in the sector has left the priorities of owners and contractors at odds with one another.

“For contractors, I think they’re pricing the risk, trying to capture the potential for cost increases in the contract itself,” said Lee. “Owners, on the other hand, I’ve seen trying to minimize the ability for contract prices to increase, which includes limiting sizeable contingencies.”

Beyond the terms or numbers on these contracts, Annibale believes that it’s ultimately a collaborative relationship between these owners and contractors, built on mutual transparency and flexibility, that will provide the profitable path forward for an industry feeling the squeeze.

“It’s essential to move away from a rigid, positional posture, and towards one that considers the best interests of the project overall,” he said. “That requires a bit of a leap of faith, but if you take that leap, I think you’re putting yourself in a position where you’ll maximize efficiency, limit delays and encourage problem-solving.”

Print this page