Features

Aggregates

Profiles

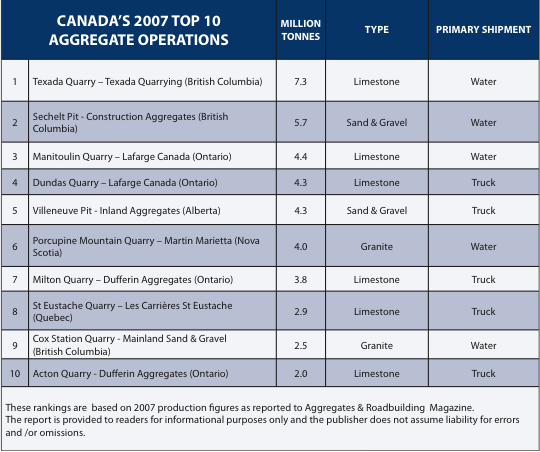

Canada’s top ten agregate operations

This exclusive report looks at what has been happening over the last year at some of Canada’s biggest quarries

August 12, 2008 By Aggregates & Roadbuilding Staff

Looking at this year’s Top 10 aggregate operations, the pattern

Looking at this year’s Top 10 aggregate operations, the pattern

established in recent years continues, with Canada’s three

biggest operations all water based and in the same order as

the previous year.

Looking at this year’s Top 10 aggregate operations, the pattern

Looking at this year’s Top 10 aggregate operations, the pattern

established in recent years continues, with Canada’s three

biggest operations all water based and in the same order as

the previous year.

Three of the Top 10 operations are located in British

Columbia, with four in Ontario and one each in Quebec, Nova Scotia

and Alberta. The top two operations reported big production increases

to pull away from the pack. Texada Quarry on B.C.’s Texada Island,

now the country’s biggest aggregate operation by far, saw a 28 per

cent jump in production while the number two operation, the Sechelt

pit of Construction Aggregates Limited on B.C’s Sunshine Coast saw

a 14 per cent jump. Significant increases were also reported by the Villeneuve Pit of Inland Aggregates,Dufferin Aggregates’ Milton Quarry

and Mainland Sand & Gravel’s Cox Station Quarry. The remainder

reported similar volumes or declines from 2006.

Kevin Spenst, general manager, Lafarge USWC Division, explains

that in 2007 the Texada Quarry underwent a number of significant

changes as well as achieving a number of significant milestones.

The quarry continued its exceptional safety record with no lost time

accidents surpassing five years and was recognized by the Ministry of

Mines with the Stewart O’Brian award for Safety Excellence.

Record sales from the quarry for 2007 were 7.3 million tonnes, due

to the addition of over 1.0 million tones of material sold to the Deltaport Project along with asphalt aggregate sales to Grace Pacific in Hawaii, and limestone sales to Cemex in San Francisco. Spenst adds that

productions and sales volumes were virtually the same last year. The

quarry implemented of a number of important pieces of equipment in

2007. The addition of an upgraded X-Ray system in the laboratory

along with a complete quarry GPS System will ensure the quarry production meets the high specification demands in the market for years

to come. Successful completion of a fleet equipment study ended with

the ordering of a number of new pieces of equipment in 2007. A Caterpillar 992 wheel loader, a 777 haul truck, a D10 dozer and a Komatsu

300 excavator were all ordered in 2007 for delivery in 2008. Another

feed bin was added to the shiploader in 2007 to increase the feed capacity by another 1000 tonnes/h. With the enormous amount of work

in 2007, there was no time for any major capital upgrades. Crushing

plants were “maxed out” in 2007 as Texada produced record levels.

A number of new areas in the quarry were developed for additional

A number of new areas in the quarry were developed for additional

reserves. A new granite area was opened exposing additional sources

for construction aggregates, along with a new white limestone quarry

for specialty aggregates.

Spenst adds that (Texada’s) market demands in Canada have not

slowed and expectations are for the current trend to continue for the

next few years. The slowing economy in the U.S. has affected some

large projects, but this has been somewhat offset by lack of available

reserves in the immediate demand areas.

At the Sechelt pit of Construction Aggregates Ltd, Canada’s biggest sand and gravel operation, mine manager Mike Latimer reports

that the operation processed 5.7 million tonnes in 2007 and sold 5.1

million tonnes. There were no significant changes to the process,

equipment or suppliers. For 2008, Latimer adds that the operation is

shooting for 6.1 million tonnes processed for 2008 as its sister operation in Victoria (Producers Pit) has shut down and is reclaiming

stockpiled material only.

Perry Newman is manager at the Manitoulin Quarry of Lafarge

Canada Inc. Newman reports a difficult year in 2007 due to a number

of external factors. Chief among these was the strong Canadian dollar

as most of the demand for this Ontario water based operation’s products stems from U.S. markets on the Great Lakes. As Newman points

out, 2007 was the first time since the quarry began operation in May

1981 that the value of the Canadian dollar has exceeded the U.S. dollar. In tandem with the exchange rate issue Manitoulin has, like many

other Canadian exporters, felt the downdraft of a slowing U.S. market.

In addition, the quarry’s shipments have been impacted by lower water levels in the Great Lakes, with Lake Huron at or near record lows in fall 2007. Those low water levels translate into fewer tonnes per

shipment to deal with reduced draft at some

customer dock locations. Finally, Manitoulin has experienced labour challenges, with

the loss of some experienced employees to

the expanding base material mining industry

around Sudbury. These challenges notwithstanding, Manitoulin retains its position as

one of Canada’s biggest quarries with 4.4

million tonnes of production in 2007. Sustaining capital investment last year included

two new pieces of Caterpillar mobile equipment, a 777F haul truck and a 14M grader,

with the status quo maintained on the process

equipment side.

At Lafarge Canada’s Dundas, Ont. crushed

stone operation, quarry manager Ron Graham

reports that recent capital additions include a

Metso HP500 cone crusher, installed during

winter 2007/2008. The HP500’s job will increase the yield of clear sized stone at the operation’s secondary plant and in terms of process flow, is located after a Metso Nordberg

2.1 m cone crusher and ahead of two Konica

vertical shaft impact (VSI) crushers.

At the face, a new Caterpillar 992G has replaced

another 992G for primary loading duty. The

typical primary load and haul set up at Dundas includes a Caterpillar 992G wheel loader

teamed with a 990 high lift wheel unit to load

three Caterpillar 777D haulers. In terms of

business level, Graham expects 2008 to be

similar to Dundas’ 2007 production tonnage

of 4.3 million tonnes.

Brian Puchala, operations superintendent

Northern Alberta at Inland Aggregates’ Villeneuve plant near Edmonton, reports that the

2008 construction season is well underway

after cold weather and snow well into April.

In Puchala’s view, there has been a easing of

labour shortages due to the recent slowdown

in Alberta’s booming oil and gas industry, although there is still the possibility of upgrader plant construction east of Edmonton. On

the construction side, the start of the north leg

of the Anthony Henday Parkway will boost

demand, with construction expected to start

this fall. In terms of overall 2008 volumes,

Puchala expects this year to be similar to or

slightly lower than 2007 when the Villeneuve

plant produced 4.3 million tonnes from raw

material supplied by two nearby pits.

Administration manager Dan Fougere reports that the Porcupine Mountain quarry of

Martin Marietta Material Inc. in Nova Scotia

produced 4.0 million tonnes in 2007. On the

marketing side, a close eye is being kept on

U.S. as the operation’s primary market, with

the strength and timing of the recovery of the U.S. market likely to impact capital investment decisions here.

Antonio Mascarenhas, site manager at

Dufferin Aggregates’ Milton Quarry explains

that water management at the property is accomplished using a state-of-the-art water

management system. The water management

system collects surface water and groundwater to maintain dry working conditions in

the Main Quarry and North Quarry. Water in

the quarry is collected in dewatering sumps

and conveyed to a reservoir where it is stored

and eventually discharged for quarry operations or environmental mitigation. Two main

dewatering sumps are used, including one in

the Main Quarry and one in the North Quarry.

Additional satellite sumps, channels, and culverts are used as necessary to convey water to

the main dewatering sumps. The main dewatering sumps  discharge water to the reservoir,

discharge water to the reservoir,

which is located in the Main Quarry. Some

of this water can be diverted to quarry operations, as needed. The reservoir is the most

visible component of the water management

system at Milton Quarry. Occupying an area

of approximately 70 ha, the reservoir can

store 5.5 m3 of water (including 1.7 million

m3 in the normal Main Quarry gravity outflow operating range (306 to 309 m AMSL)

and an additional 2 million m3 of reserve

capacity above the Main Quarry pump outfl ow

elevation of 303 m AMSL). To give some idea

of the relative size of the reservoir, the total

and active holding volumes of nearby reservoirs are; Hilton Falls, 1.8 and 1.0 million m3,

Kelso 1.5 and 1.0 million m3 and Scotch

Block 1.8 and 0.6 million m3.

Pumping stations at Dufferin’s reservoircan provide water to quarry operations, the

Pumping stations at Dufferin’s reservoircan provide water to quarry operations, the

Hilton Falls Reservoir Tributary, and the

North Quarry Recharge Well System. Duf-

ferin Aggregates discharges water from

Milton Quarry to the HFRT. Discharge

to the HFRT is determined annually with

Conservation Halton in order to maintain

natural fl ows in the tributary. At the present

time, the total annual discharge from Milton

Quarry to the HFRT is 700,000 m3. Dufferin

Aggregates operates in the North Quarry

Recharge Well System around the western

portion of the North Quarry. The North

Quarry Recharge Well System consists of a

pumping station at the reservoir, 2.6 km of

water main (600 mm to 300 mm diameter),and a series of 20 recharge (injection) wells with flow control systems. The recharge wells are operated to mitigate the dewatering effect from the North Quarry to prevent any adverse effect on the water resources in the area, including private water supply wells, coldwater fisheries, and wetlands. The recharge  system is operated to maintain the natural seasonal water levels using an adaptive management approach which recognizes the inherent variability of the natural environment. As Milton Quarry expands to the north into the approved extension lands, the recharge well system will be extended by approximately 3.5 km to provide protection to the water resources in that area. In terms of production, Mascarenhas expects that 2008 will see a similar level of production to the 2007 total of the 3.82 million tonnes. Volumes have rebounded following poor weather in March, although the expects another good year overall similar to

system is operated to maintain the natural seasonal water levels using an adaptive management approach which recognizes the inherent variability of the natural environment. As Milton Quarry expands to the north into the approved extension lands, the recharge well system will be extended by approximately 3.5 km to provide protection to the water resources in that area. In terms of production, Mascarenhas expects that 2008 will see a similar level of production to the 2007 total of the 3.82 million tonnes. Volumes have rebounded following poor weather in March, although the expects another good year overall similar to

2007 production of 2.0 million tonnes. Acton’s

volumes are, in the long run, something of a

barometer of the regional roadbuilding sector’s

health as its principal products are granular road

base as well as 9.5 mm and 19.5 mm coarse asphalt aggregates. In 2006, for instance, its volumes were lower for a while as the spike in oil

prices triggered a jump in asphalt cement prices

which in turn squeezed roadbuilding budgets.

Capital additions in 2007 included a Caterpillar 777F haul truck, increasing the primary haul fleet to six in order to maintain

Capital additions in 2007 included a Caterpillar 777F haul truck, increasing the primary haul fleet to six in order to maintain

production rates from the quarry’s Phase 3

development. Another 777F will be acquired

in 2008 as a replacement truck for one of

the fleet’s older units. This year will also see

the delivery to Acton of a second Caterpillar

990H high lift wheel loader, also as a replacement machine and, for the first time, two John

Deere 844K wheel loaders. On the processing

side, new equipment includes a Thor 914 mm

x 45.7 m stacker. Still on operations, 2008

will be something of a milestone year for Ac-

ton in terms of rehabilitation. With most of

the soil already in place, this year will see the

final rehabilitation on the eastern half of the

quarry’s Phase 2 area.

Print this page