Features

Aggregates

Profiles

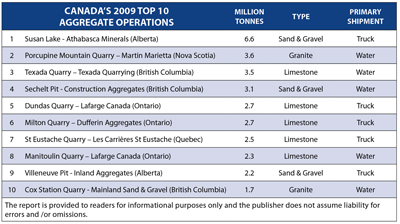

Canada’s Top 10 Aggregate Operations

Flat was the new up in 2009, with all of Canada’s biggest aggregate producers reporting declines

June 10, 2010 By Andy Bateman

By any measure, 2009 was a tough year for Canada’s biggest aggregate operations.

By any measure, 2009 was a tough year for Canada’s biggest aggregate operations. To get some sense of how tough, it is interesting to compare the combined output of the Top 10 in 2009 producers with the previous year.

|

|

| Capital replacements in 2009 at the Lehigh Materials Sechelt operation included this Sepro 2.4 x 4.2 m stone scrubber. The rubber tire driven Sepro unit is reportedly the first of its kind in North America.

|

In 2008, the Top 10 operations reported a total of 45.6 million tonnes of production. By contrast, the total reported by the Top 10 in 2009 fell by nearly a third to 30.8 million tonnes. Within the combined total, the big producers of British Columbia and Alberta reported declines of over 30 per cent, while most of Ontario’s producers fared somewhat better with declines in the 20 to 25 per cent range. Relative bright spots included the St Eustache Quarry of Les Carrières St Eustache in Quebec and the Porcupine Mountain Quarry of Martin Marietta in Nova Scotia, both of which moved up the Top 10 ranks simply by maintaining 2009 volumes close to 2008.

Athabasca Minerals, Susan Lake

The Susan Lake sand and gravel operation of Athabasca Minerals retained its title of Canada’s biggest single aggregate producing location with 6.59 million tonnes, despite posting the steepest year over year drop, 44 per cent, of any of the Top 10 producers. (Athabasca Minerals data is reported for the fiscal year ended November 30th).

|

|

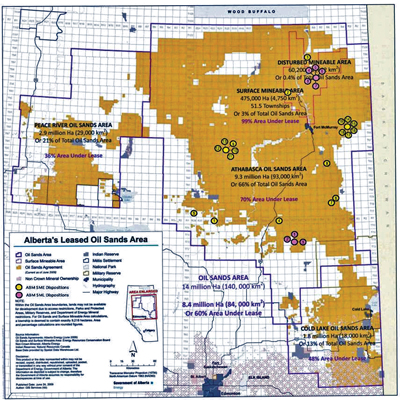

| Alberta’s massive leased oils sands area, home to the Susan Lake sand and gravel operation of Athabasca Minerals, covers 14 million hectares or 140,000 km2.

|

Susan Lake is unique among the Top 10 listing as its production number is the combined total of a number of separate portable production spreads, operated by different companies on the same property. Dean Stuart of the Boardmarker Group reports that 2009 brought nothing new at Susan Lake on the operational side, with the same weigh scales and numerous trucks (including heavy haulers) carrying aggregates from Susan Lake to a variety of projects in the Wood Buffalo region.

In June 2009, Athabasca Minerals received a request for an additional 1.7 million tonnes of aggregate for a major oil sand project, an additional request as the 2009 forecasted demand was 6.3 million tonnes, of which 500,000 tonnes was delivered during the year. It is expected that the balance of this aggregate request will be delivered in 2010. Since the beginning of the management contract with the Alberta Government in 1998, 18 per cent of the Susan Lake aggregate operation has been developed for aggregate extraction.

The company has also received one additional gravel lease (Logan River), and has applied for an additional seven Special Mineral Leases (SML’s). In addition, 17 gravel exploration permits (Surface Material Agreements or SME’s) have been applied for or approved by the Alberta Government. The Logan River aggregate project is located 160 km south of Fort McMurray, and Athabasca Minerals expects to have an independent report to determine the quantity of aggregates available completed, compliant with National Instrument 43-101, later this year. Stuart adds that there are a number of oilsands projects moving forward, including Imperial Oil Ltd.’s $8 billion Kearl project and three expansion stages at Suncor Energy Inc.’s Firebag oilsands project that will eventually add output of 188,000 barrels of bitumen a day.

|

Martin Marietta, Porcupine Mountain

The Porcupine Mountain Quarry of Martin Marietta in Nova Scotia rose from fifth to second place in this year’s report, thanks to a relatively modest three per cent decline in volumes from 3.7 to 3.6 m tonnes. Marietta’s Dan Fougere adds that “production stagnated due to the economic recession”, although this did not prevent the addition of a 0.9 m tonnes/annum capacity modular plant capable of making specialty products.

Lafarge Texada

At the Lafarge Texada Quarry on B.C.’s Texada Island, general manager Kevin Spenst reports that 2009 volumes fell to 3.5 m tonnes, a sharp decline from 6.0 m tonnes in 2008 and 7.3 m tonnes reported in 2007. Project work along the Pacific Northwest slowed with the declining economy, says Spenst, and preparations for the 2010 Olympics halted most construction projects in the Vancouver market.

|

|

| Located on B.C’s Texada Island, the main customer base of the Lafarge Texada operation continues to be the cement and chemical lime plants along the Pacific Rim. |

The quarry continued with its outstanding safety record with no lost time accidents surpassing seven years. Safety and the environment are keys to a sustainable future in the mining business, adds Spenst. Lafarge completed and is implementing an Environmental Management System in efforts to continue to lead the industry in environmental awareness. On the operational side, improvements at the quarry in 2009 were derived from numerous cost cutting measures. Items like fuel consumption, scheduling, and plant maintenance led the savings in 2009. There were no major capital expenditures at the quarry in 2009.

Texada’s main customer base continues to be the cement and chemical lime plants along the Pacific Rim. Specialty aggregates such as white rock, heavy weight aggregates and RipRap will be key to Texada’s growth in future years. Texada continues to trans-ship products such as coal, gypsum, and slag to customers requiring storage and large ship loading.

Lehigh Materials, Sechelt

Mike Latimer is mine manager of the Sechelt, B.C. sand and gravel pit of Lehigh Materials. Latimer reports that the operation’s shipments of 3.07 million tonnes in 2009 included 601,000 tonnes to California. Sales of concrete aggregates were reduced from 2008 by at least 60 per cent. Diversification into road bases and specification fill products enabled the plant to operate on a two shift basis for most of the year until inventory volumes and poor weather necessitated a four week production shutdown in December. Production is currently matched with sales through operation of a single (five days per week) shift. Overall, says Latimer, we are in a “wait and see” pattern and hoping 2010 will bring more business than 2009.

Capital replacements of plant equipment in 2009 at Sechelt included the installation of a Sepro 2.4 x 4.2 m stone scrubber, with the rubber tire driven Sepro unit reported to be the first of its kind in North America. 2009 also saw the installation of a Binder 2.8 x 5.5 m rock dewatering screen.

Inland Villeneuve

Brian Puchala, operations superintendent at the Villeneuve Pit of Inland Aggregates near Edmonton, Alta. reports 2009 production of 2.2 m tonnes. Puchala is one of the few producers to report any significant mobile equipment investment last year, with the Villeneuve operation adding a Komatsu 155 dozer as well as Caterpillar 980H and Komatsu WA 500 wheel loaders to its fleet. The dozer is being used to push material at the operation’s three surge piles for plant feed, while the loaders will be on loading and material handling duty. Puchala’s forecast for Villeneuve’s’ 2010 production tonnage is 2.5 million tonnes, spurred by a pick up in the residential sector and projects such as the northern section of Edmonton’s ring road, Anthony Henday Drive.

Lafarge Dundas

At the Lafarge Dundas, Ont. operation, quarry manager Ron Graham reports 2.7 m tonnes of production for 2009, which, though representing a 25 per cent downturn from the 3.6 million tonnes reported for 2008, allowed Dundas to retain its fifth place position in our Top 10. Graham was certainly underwhelmed by overall product demand in 2009 which was adversely impacted by low activity levels in all the quarry’s construction markets as well as the erratic fortunes of Hamilton’s steel plants.

Dufferin Milton

Holcim Canada’s Rob McDougall reports that the Milton, Ont. quarry of Dufferin Aggregates produced 2.7 m tonnes in 2009, rising two places from the previous year to take sixth place in our Top 10 ranking. The company’s nearby Acton quarry produced 1.6 m tonnes to just miss the Top 10 this year and take 11th place. McDougall explains that the market in 2009 showed a trend of increased demand for clear stone products. As a result, both Acton and Milton made adjustments to maximize the yield of these products to meet market demand and manage inventories. 2010 will show many of the same challenges as 2009, says McDougall, with the primary focus at both sites aimed at reducing operating costs and improving operating efficiency. The Milton Quarry did receive one new piece of equipment during the winter of 2010, a new hydraulic rock breaker that was installed at the primary crusher. The replaced unit was showing signs of deterioration and resulted in reduced downtime issues at the primary. This new unit is a Techman breaker, equipped with the ability to operate a hydraulic hammer and switch to a bucket that can be used to clean the crusher bowl. This cleaning activity is required for maintenance personnel to safely perform preventative maintenance routines and repairs that in the past were conducted by a hydraulic excavator at additional cost.

Mainland Sand and Gravel, Cox Station

Ted Carlson and Brian Weeks of Mainland Sand and Gravel in B.C. reported 2009 production of 1.7 m tonnes for the company’s Cox Station quarry to remain in the number 10 slot, in spite of a 32 per cent drop from the previous year. Carlson explains that a number of changes were necessary to deal with the drop, including reduced production shifts and significantly less overtime. Capital expenditures were small compared to recent years, totalling less than $400,000 and including a Caterpillar 328 excavator, pick up trucks and conveyors. The engineering and design has been completed for the installation of the 54-74 primary crusher in the east quarry, but the actual installation has not begun at this point. Work is now focussing on the design of the secondary crushing and screening plant.

Fuel costs have run up again, adds Weeks, while wait times for parts have risen to as much as two days as suppliers move towards centralized rather than local distribution. Electricity costs are also expected to rise. Going forward, capital expenditures are expected to remain modest and focussed on the crushing plant expansion. Looking further ahead, the company plans to increase the stockpiles of inventory near the barge loading area from which products or product fractions will be recovered and conveyed to the existing barge loading belt. At present, finished products are hauled by truck to the barge loading hopper from product stockpiles within the process area.

In terms of market demand, 2010 is currently trending about 10 to 15 per cent better than 2009 and Carlson predicts 2010 will finish about 20 per cent higher than 2009. A small amount of that growth will come from new products, although these tend to be relatively small volumes. There is a “decent” recovery in house building which underscores the importance of residential construction to aggregate demand. “We can tend to become too focussed on the big infrastructure projects and roadbuilding whereas residential construction is a key underpinning to the overall demand for aggregates,” says Carlson. Infrastructure stimulus money is now beginning to flow through with federal support, for instance, part of an $80 m infrastructure program in nearby Abbotsford.

Lafarge Manitoulin

Perry Newman, plant manager of the Lafarge Group’s Manitoulin Quarry located at Meldrum Bay, Ont., notes that there was “not much to report at Manitoulin for 2009, with final production of 2.3 m tonnes.” The Manitoulin operation reported the biggest drop of the Ontario based quarries in the Top 10 to slide from fourth to eighth place. As Newman points out however, Manitoulin’s volumes are directly impacted by the fortunes of the U.S. economy because a significant percentage of the quarry’s output is shipped to U.S. markets on the Great Lakes.

Atlantic Minerals, Lower Cove

Although not in our Top 10 listing, the Lower Cove quarry of Atlantic Minerals Limited (AML) gets an honourable mention this year. AML, a subsidiary of Newfoundland Cement Company Limited, has taken bold steps to seek new markets and make significant capital investment in the business, despite a punishing 71 per cent drop in production from 2.2 m tonnes in 2008 to 700,000 tonnes 2009. President William Fitzpatrick explains the collapse of the steel industry in late 2008 resulted in significant reduction in 2009 sales for chemical grade limestone and dolomite, for both steel manufacturing and iron ore pellet industry. To offset these declines, Fitzpatrick adds, “we are pursuing markets for chemical stone in Uruguay, Chile, Argentina and Brazil. We currently sell some material in Brazil and are looking to expand this market in 2010. Additionally, we are following several construction opportunities in the Caribbean and Africa. Customers are indicating that steel and iron ore markets will improve throughout 2010 to approximately 2007 levels but not as strong as those seen in 2008. On the operational side, we have ordered a large VSI crusher system from Kolberg Pioneer (KPI-JCI) with a Super Stacker, interconnecting conveyors and two high frequency screens for installation in June 2010. This system will be used to produce additional 6 mm minus and #89’s for which we have orders.”

Fitzpatrick’s comments echo those of a number of producers who are seeing at least modest improvements in 2010 and expect to finish better than 2009 overall. We certainly hope they are right.

Print this page