Capital may be tight and residential construction may be declining, but some producers and suppliers across the country are predicting a surprisingly robust 2009.

|

In talking to industry people around the country, the overall impression is that things are significantly better than the daily diet of doom and gloom might indicate. Producers and suppliers remain relatively upbeat despite widespread declines in the residential sector. Quebec and Alberta remain bright spots according to respondents while Ontario is looking to infrastructure spending to fill the residential gap. Overall, most are forecasting a reasonable 2009 after the record and sometimes unmanageable levels of recent years.

Jean-Maurice Forget, general manager for Demix Aggregates and Demix Construction, reports generally good news for the Greater Montréal market. 2008 was a good year, driven by strong municipal programs as well as the major provincial infrastructure program set in motion two years ago to repair bridges and rehabilitate major roads. Data produced by the Québec Construction Commission estimates 2008 industry wide construction growth of five per cent compared to 2007, based on the number of man hours worked. For that period growth by construction sector included 10 per cent in roadbuilding and heavy construction, three per cent for residential and five per cent in institutional and commercial construction, with a three per cent drop the industrial sector the only downside number.

|

|

| Residential construction has declined across Canada. Photo: APA – The Engineered Wood Association |

|

|

|

| The Jervis Inlet B.C. operation of Jack Cewe Limited. Advertisement

|

On the operational side, aggregate producers have given a mixed response to the new province wide extraction right which took effect on January 1 2009. Under the new right, all producers will be paying 50 cents per tonne to the local municipality in which an operation is located. The collected funds are to be used to improve municipal roads impacted by aggregate operations, with some $40 million flowing to the municipalities based on total provincial aggregate production of around 80 million tonnes.

Probably the most significant change on the operational side is the sharp drop in capital investment.

Parent company Holcim, a major global player in cement, construction materials and construction services, is feeling the downdraft of the economic situation and has significantly curtailed the availability of capital funds worldwide. The result for the Demix Aggregates operations is 2009 capital investment reduced to only 10 per cent of the 2008 figure, and even some of that figure is allocated to the completion of a mid sized crushing plant rehabilitation. As a result, capital plans for new process automation, screens and other fixed and mobile equipment have been delayed.

On the construction side of the business, skilled trades remain hard to find in Quebec. Data for 2008 indicates that 14,000 new workers entered construction in 2008, of which an estimated 5,000 were the result of growth and 9,000 were required to replace workers leaving the industry. For 2009, it is expected that there will be 11,000 new entrants, all of whom will be replacing those leaving due to retirement, migration and other reasons. On that point, M. Forget notes that provincial migration to other provinces remains relatively low, the result of a buoyant domestic scene as well as the language factor.

Provincial forecasts for 2009, again measured in man hours, indicate a

steady situation with overall numbers similar to 2008 and roadbuilding,

energy and other infrastructure projects continuing to make a

significant contribution. Looking in more detail, work in the

roadbuilding and heavy construction sector is expected to grow by no

less than 12 per cent, with the industrial sector remaining flat and

declines of seven per cent and two per cent in the residential and

institutional/commercial sectors respectively. Putting this all

together, Forget expects Demix to see strong and steady roadbuilding

during 2009, a slight fall in the demand for aggregates and a bigger

drop in concrete demand, reflecting the volumes of construction

materials consumed by each industry sector.

In Nova Scotia, Kim Conrad of Dartmouth based Conrad Brothers reports a

good 2008 after a record 2007, with the company’s Dartmouth quarry

producing some 1.1 million tonnes compared to 1.4 million tonnes in

2007. Business levels have been boosted by the development of new

products such as Microdust, a fine aggregate that has been used in

micro-surfacing applications as far away as Cape Breton. Conrad has

also had some success building strategic alliances with area

roadbuilding contractors to develop additional outlets for quarry

products.

The inconsistent application of “guidelines” for aggregate producing

operations is a long standing complaint of Conrad’s and is, in his

view, showing little sign of improvement. On one hand, permanent

aggregate operations such as Conrad’s are subject to the full suite of

environmental and other regulations and monitoring while portable

aggregate operations on construction sites often appear to be exempt

from such regulations. According to Conrad, there are also instances

where aggregates generated on construction sites are being sold

elsewhere, thereby falling under the definition of a quarry operation.

The provincial government’s view on in-town crushing and processing is

that these operations are part of development and feel this is handled

by the municipality. However, the municipality has no set bylaws in

place to deal with such operations. A 118 page study has been presented

to council and includes a study of onsite crushing and processing of

construction materials such as cement block, concrete and brick.

|

|

|

|

|

|

| Source: Reed Construction Data – CanaData

|

Labour issues persist and it can, for example, be difficult to find trained loader operators as “everyone headed west.” Training programs by equipment manufacturers have been a valuable aid to help fill the skills gap and there are also signs of a reversal of the labour tide with things cooling off in the oil driven Alberta economy.

Looking into 2009, Conrad’s view is that “the boom has levelled off but there is a still a lot of municipal infrastructure money.” In the Halifax Regional Municipality (HRM) itself, a $400 million sewer system is nearing completion although there will be ongoing upgrades to roads and sewers on an as needed basis. In addition, the provincial Department of Transport has earmarked $285 million for the highway system although it is not clear if there actually any new money. Residential construction activity level is expected to modest.

Putting this all together, Conrad predicts a solid if not stellar 2009, with quarry output staying above 1.0 million tonnes. On pricing, 2008 prices increases for aggregates helped somewhat to offset increase in production costs such as electricity but did provide an overall increase in margins. For 2009, Conrad feels that FOB quarry prices are likely to remain stable, with the market resistant to increases in excess of two or three percentage points except for some specialty products. On delivery costs, Conrad explains that base haul rates have been increased by 10 per cent to 14 per cent to come more into line with current costs. At one point, fuel surcharges reached 40 per cent on some contracts, due to a combination of dated base rates and record diesel fuel prices. That situation has been more or less corrected and delivery rates are also expected to remain stable during 2009.

In Alberta, Gary Zeitner of Mixcor Aggregates Inc. notes that “although government spending on infrastructure development and rehabilitation remained strong, the key issue impacting business in 2008 was the drop in residential housing sales and development. This impacted aggregate sales as volumes of concrete, concrete products, asphalt, and road base were down in some regions by as much as 30 per cent versus 2007. Pricing was strong into the spring until increased competition entered the market, forcing prices for some common materials to drop due to the increased competitive pressure. Similarly, contract crushing prices remained strong through the first half of the year but fell off in the second hand as work volumes declined.

Government infrastructure spending looks to remain as strong or stronger for 2009 as in 2008. While many industrial projects have been delayed, there is still a backlog of industrial projects underway that will take some time to complete. Residential housing inventories are being slowly reduced, but significant new residential development is not being contemplated until at least the third quarter of 2009. Mixcor sees continued competitive pressures for the work that is available, and good value available to project owners that can access the capital to proceed. Increased competition from 2008 in both the Aggregates sector and the Roadbuilding sector will continue in 2009, keeping prices from experiencing significant increases. Zeitner also expects that aggregates industry capital expenditures on both fixed and mobile equipment will be reduced in 2009, as some companies experience a shortage of available capital while others will choose not to expand in a time of increased competition.

New technical issues for 2009 include the Alberta Government’s Environment ministry full implementation of its Code of Practice for Gravel Pits in 2009, leading to stricter reporting requirements and easier-to-levy administrative enforcement fines facing aggregate producers. Specification changes for asphalt gradation in the City of Edmonton mean that aggregate and asphalt producers will face nine sieve size control points instead of four.

Jim Allard of Allard Contractors, based in Coquitlam, B.C., described 2008 as “unbelievably busy”, at least until September. Aggregate and ready mix concrete shipments to the residential sector then dropped abruptly by about 50 per cent reflecting a rapid cooling in the construction of medium rise apartments and single family homes. According to Allard, this downturn in the company’s market on the north side of the Fraser River was reflective of the rest of B.C’s Lower Mainland and Vancouver Island markets. Despite the year end drop, overall 2008 volumes were on par with 2007, thanks to some stronger spring months. Allard’s capital expenditure program in mobile equipment was reduced in 2008 with the acquisition of one used loader compared to six new trucks in 2007. There was, however, more invested on the process side, with about $1 million committed for the twinning of the ready mix plant in the company’s Coquitlam pit.

One of the key drivers of increased operating costs in 2008 was regulatory compliance with water quality management and permitting once again consuming disproportionate resources for the scale of the business. Nevertheless, Allard believes that the Campbell government now recognises the problem of over regulation in the aggregate industry and will take steps to cut some of the red tape if re-elected in the May 12, 2009 provincial election.

For 2009 as a whole, Allard believes that British Columbia is by far the best positioned of any province with the expected roll out of numerous infrastructure projects in the $0.5 million to $5 million range, including sewer and water mains, schools, roads and small bridges. These will be layered over several existing major regional projects including the Sea to Sky Highway, the Golden Ears Bridge, the Pitt River Bridge, the Vancouver Convention and Exhibition Centre, Richmond/Airport, Vancouver Rapid Transit (RAV) project as well as additional 2010 Winter Olympics spin off work. Soon to join this list are the twinning of the Port Mann Bridge and the south perimeter highway. It is this combination of major and smaller projects that should help offset the downturn in residential construction for materials suppliers. “The bigger suppliers will likely be kept busy supplying the big projects with smaller players such as us securing a share of the smaller projects.” All this infrastructure work, however, will not be enough to compensate for the downturn in the key residential sector and Allard is predicting a fairly sharp 15 per cent overall drop in volumes for 2009. Profit margins may fare better, thanks to the sharp drop in crude oil prices translating into reduced energy costs. Some cost reductions may also flow from the labour side as job opportunities and hourly rates shrink, even for skilled trades.

Brad Kohl, general manager of Greater Vancouver Aggregates for Lafarge Canada Inc., reports that the key issues impacting the business in 2008 were infrastructure and housing, with these market sectors trending in the opposite direction. Infrastructure work positively impacted the market while housing and general market pessimism negatively affected the later half of 2008 and according to Kohl will continue into 2009. The overall level of business activity in 2008 was some 15-20 per cent below 2007 volumes. 2008 “started out with a bang and ended with a bust,” although the company still invested $4 million in fixed equipment and $4.5 million in mobile equipment. Prices for aggregates were generally up eight to nine per cent compared to 2007.

Looking forward, Kohl predicts a very slow start for the first three to four months of 2009 accompanied by little or no product price increase. A drop in volumes, down another fifteen to twenty per cent from 2008 is expected, with declines in housing, commercial building and infrastructure spending. The company’s capital investment levels will also be lower at some $1 million each for fixed and mobile equipment, with equipment costs increased by the drop in the value of Canadian dollar against the U.S. dollar, albeit from record levels. Like many other producers, Kohl sees the availability of capital in the marketplace as a key driver of overall economic conditions in 2009.

Malcolm Matheson, president of Kitchener Ont. based Steed and Evans Limited describes 2008 as “reasonably good”, although there has been a significant downturn in residential subdivision work.

Matheson estimates that the markets of Kitchener Waterloo, London and Niagara in 2008 were perhaps three per cent to fiver per cent off overall from 2007. One of the effects of the decline in subdivision work has been increased competition for reconstruction work as residential contractors look for work in other sectors. In the Kitchener-Waterloo market, there has been some indirect impact from the troubled Windsor market, with Windsor contractors seeking work further east in London and London based contractors in turn “bumping” into the Kitchener-Waterloo market. North of the Greater Toronto Area, a big slowdown in the residential construction has reduced demand for most construction materials including aggregates, asphalt and concrete. Volatile asphalt cement prices in 2008 made life challenging for estimators while owners found that budget dollars did not travel as far as previous years.

For Matheson, a falling Canadian dollar and the resulting 20 per cent increase in the cost of U.S. built equipment was an important factor in capital investment decisions. By way of example, the company was going to replace a wheel loader but decided instead to postpone the purchase and squeeze another year out of the ageing machine.

The regulatory framework is not getting any better, with townships introducing bylaws on aggregate producers that are over and above the requirements of the Aggregate Resources Act (ARA). Matheson feels that the aggregate industry still has work to do in the community relations area to demonstrate the difference between environmental “conservation” and “preservation” in the political and public arena. Too often the goal of some is to block the aggregate industry altogether rather than recognising the concept of interim land use.

Looking forward to 2009, Matheson predicts an across the board slowdown of 15 per cent compared to 2008. The good news is that the Kitchener-Waterloo market in particular should have significant reconstruction business to deal with the region’s accumulated infrastructure deficit in street, sewer, water main and related construction. The level of competition for that work is expected to increase, as already demonstrated by one recent project list where the bidders’ list contained 16 companies compared to the typical six or seven. Margins are likely to become tighter and may result in a number of contractors disappearing from the scene. Steed and Evans itself has considerable resilience to face tough times thanks to multi year road maintenance contracts providing steady work and, perhaps more important, a stable and experienced workforce.

Like many contractors, Matheson is taking a wait and see approach to municipal budgets to see how things develop in Spring 2009. Any initiatives to fund federal or provincial infrastructure programs are also welcome, but unless projects are ready to go the design and approval system is too cumbersome to have any immediate impact.

On the operational side, the labour market has eased significantly with operators from the pummelled auto and other manufacturing sectors suddenly in the marketplace and looking for work. Energy costs should decline, with lower crude oil prices reflected in lower asphalt cement and energy costs in 2009. Staying on energy, there is increased awareness of sustainability issues and carbon footprint, but there is still a long way to go before such initiatives gain general acceptance with project owners and designers.

For Matheson, the big question is how long it will be before there is a solid upturn in the economic cycle. There are those who think things should start improving as soon as the middle of 2009 while others are of the view that we may have to wait until 2012. The most pessimistic view heard to date is that a sustained recovery will not occur before 2018. If the latter projection is correct, 2007 and 2008 will soon be known as the good old days.

Steve Pegler of Elrus Aggregate Systems reports a very strong 2008, with sales for the financial year ending September some 25 per cent higher than 2007 for another record year. Elrus is expecting a slight manufacturing slowdown during the winter of 2008/2009, although office staff will be kept busy by enquiry levels that are even higher than last year. Business prospects remain strong, particularly in western Canada with a continued emphasis on Alberta and Saskatchewan. The company’s national coverage continues to grow with a new Quebec sales territory. In Ontario, the Listowel and Guelph operations will be combined and expanded to provide additional services. Product mix has remained similar to previous years with portable plants particularly popular in the growing Saskatchewan market.

In Elrus’ home province, the recent tumble in crude oil price has certainly slowed but by no means stopped the development of Alberta’s oil sands deposits. As Pegler points out, many current and committed development projects are continuing on top of a firmly established base. Out of perhaps $125 billion investment in the oil sands business, some industry observers are indicating that around $45 billion worth of development has either been deferred or cancelled, still leaving a massive investment program of “only” $85 billion.

Overall, Pegler predicts that 2009 business volumes will be some five percent below 2008, or back to “manageable” levels. In some ways, a modest slowdown would be good news for companies such as Elrus, at least on the production side. A softer labour market in other sectors of the economy means more skilled workers looking for opportunities in the aggregate equipment supply business and improved employee retention. On the marketing side, a potential barrier to sales might be the inability of equipment purchasers to obtain the necessary capital from lenders. Like most suppliers, Elrus is not directly involved in the financing business although it does facilitate the meeting of customers and financers when requested. Still on capital, Pegler observes that the regional operations of large public companies may experience difficulty in obtaining capital from parent Boards focussed on cash reserves. If that proves to be the case, smaller private and family owned businesses may have the edge with their relatively streamlined and fast decision making processes.

Bob Mohr of Mormak Equipment describes 2008 “as another good year”, with final sales numbers for 2008 similar to 2007 at some $35 million. Like most companies in the aggregate supply business,

Mormak experienced something of a slowdown in October and November although that quieter period provided a welcome opportunity to build inventory. Once again, portable plants accounted for about 85 per cent of total sales, with current orders including four power vans, a closed circuit plant for a customer in Saskatchewan and a jaw plant destined for Fort McMurray.

Mohr is upbeat about business prospects for the aggregate industry and feels that the negative aspects of the economic situation are being overblown. As a manufacturer and supplier of aggregate equipment, one of Mohr’s traditional barometers of business prospects has been the price of used aggregate equipment at auctions. Mohr reports that auction prices are holding up, suggesting that many producers share the view that 2009 will be a busy year. Within this generally sunny forecast, there are a few areas of the business that may require extra attention. These include receivables, particularly from some customers in parts of the prairies. There, operators in the aggregate crushing business will likely operate on thin margins due to a very competitive marketplace and the arrival of new players. Some may even buy work to fund bank payments and, in Mohr’s view, a number may be vulnerable to loans being called in by nervous lenders. Should this occur, Mormak’s exposure would be limited to the rental and parts side of the business but Mohr, not surprisingly, will be keeping this exposure to a minimum.

Looking at the big picture, Mohr, like many others, finds 2009 a hard year to read. “Most of Canada’s economic downturns of the last 30 years have been relatively short lived and largely influenced by North American events. That has changed and if nothing else, the economic shocks of the last six months or so have underlined the fact that we are now operating in a global economy. As a result, the impact of economic or political events happening virtually anywhere can rapidly make themselves felt here in Canada.”

What are the economists predicting? In a recent presentation, “Canadian Construction Overview,” Alex Carrick of Reed Construction Data – CanaData, underscored Canada’s strong economic base. A huge asset is Canada’s resource wealth; Canada is self-sufficient in energy and the country’s labour markets remain relatively good. The Japanese auto sector in Ontario is strong and Canada’s financial sector is on a sound footing with no talk of failures. Credit is still readily available to business and consumers. House prices in much of Canada have stopped advancing but there is no panic selling. Canadians are not overextended in debt or mortgage commitments. Office markets remain tight with low vacancy rates – the overbuilding of previous cycles has been judiciously avoided. Inflation is low, permitting interest rates to stay down. Government finances both federal and provincial are well balanced. Construction employment trends in Canada have been favourable compared to the U.S., at least until October 2008 when Canada’s 9.8 per cent year over year gain compared to a 6.5 per cent drop in the U.S. According to Carrick, residential construction dominates total construction at 40 per cent to 45 per cent of total dollars. Engineering construction is usually a little less with non-residential building and industrial, commercial and institutional sectors (ICI) accounting for the rest.

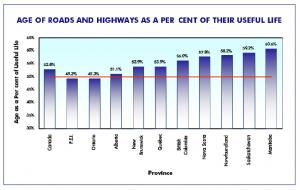

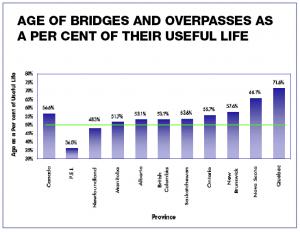

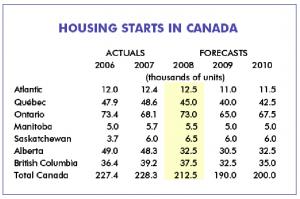

Carrick’s presentation included charts showing the age of Canada’s infrastructure as a percentage of its useful life, shown by province and major component group including bridges and overpasses, wastewater treatment facilities, roads and highways, and water supply systems, in addition to sanitary and storm sewers. According to this data, Canada’s bridges and overpasses are at 57 per cent of their useful life on average, with P.E.I. the lowest at 36 per cent and Quebec the highest at nearly 72 per cent. By comparison, Canada’s roads and highways are shown at 53 per cent of their useful life, with P.E.I. and Ontario the lowest at 49 per cent and Manitoba highest at 61 per cent. For housing starts, Carrick forecasted a Canada total of 190,000 starts in 2009 and a further increase to 200,000 starts in 2010.

According to Toronto based Altus Group Economic Consulting, Canada will have fewer starts, with a total of 165,000 housing starts in 2009 and central and eastern Canada benefiting from improved net migration. In Atlantic Canada, the wind-down of mega projects and delays of new major ones will temper housing start activity ahead, although rise in migration will be a positive factor. Rising home prices may portend affordability problems ahead.

Quebec will see a quite pronounced economic downturn, despite improved net migration, leading to dramatic cuts in housing starts. Ontario is bearing the brunt of the economic slowdown to date, and will continue to do so going forward. Weaker demand along with financing issues may put many planned projects on hold, particularly in the Toronto condominium apartment sector. The picture is brighter in Manitoba, where strong capital investment and the more stable role of the food sector will insulate this economy and housing starts somewhat compared to other regions.

In Saskatchewan, recent strong house price increases have negatively impacted affordability, which along with the downturn in the commodity sectors, will dampen housing starts. Housing markets in Alberta continue to adjust from the 2006 bubble with lower starts and prices. Now, weaker oil prices will dampen the economy, further delaying the recovery in housing starts. In British Columbia, the sharp softening in the resale market, a weaker economy, and some overbuilding in the condominium apartment sector foretell weaker housing starts ahead.

Print this page