Features

Aggregates

Profiles

State of the industry

Feedback on 2009 varies widely with location; cautious optimism for 2010 overall.

February 22, 2010 By Andy Bateman

In compiling this report, one of the most striking aspects of feedback

from producers, suppliers and economists was the wide variation in

responses, depending on province

In compiling this report, one of the most striking aspects of feedback from producers, suppliers and economists was the wide variation in responses, depending on province. The picture that emerges from B.C. and Alberta is one of a sharp downturn in most sectors compared to the heady growth of recent years. By contrast, Quebec and New Brunswick seem to be humming along quite nicely, at least in the roadbuilding sector. Saskatchewan was the only province to record a positive GDP change in 2009 compared to 2008, despite a sharp fall off in housing starts. Ontario is down but not out. Looking forward, with cautious optimism for a fragile recovery, appears to be the consensus for 2010.

|

In Alberta, Gary Zeitner of Mixcor Aggregates Inc. notes that government spending on infrastructure rehabilitation remained strong in 2009, but new residential development was stagnant until the third quarter, when some small developments commenced. Zeitner adds that increased competition and aggressive pricing from the second half of 2008 continued with prices dropping farther (25-40 per cent off the high prices of early 2008) as suppliers battled to keep enough work for their key staff. Reduced volumes also impacted trucking rates as the number of independent owner-operators has swelled over the last three years, and rates were reduced in the order of 25-40 per cent for these owner operators to continue working in a slower market. Crushing prices were similarly impacted as a number of the larger crushing services companies parked crushing spreads and sent operators home in response to reduced work volumes.

|

|

| With one or two exceptions, Canada’s major cities recorded significant downturns in housing starts in 2009. Advertisement

|

For 2010, government infrastructure spending looks to remain at similar levels to 2009. Residential development could see isolated bubbles of activity and price increases as increasing levels of home sales have depleted the localized inventories of available residential lots. Confidence in the market has stabilized as a limited number of industrial projects have commenced work, but the general consensus is that 2010 will be very similar to 2009 for the aggregates industry in Alberta. Most contractors and suppliers that we are aware of will not be undertaking any significant capital investment in 2010, and are focusing their energy on efficiency gains and sales efforts.

Reflecting a common industry trend, Zeitner also reports increasing regulation of the aggregate industry in Alberta: “Late 2009 brought the implementation of Alberta Environment’s move to the use of Code of Practice Registrations for pit operators as opposed to the previous approval process. This new registration process increases reporting requirements for pit operators while making enforcement fines easier to levy. Alberta Environment also stated their intent to more strictly enforce the Code of Practice Registrations, including implementing processes that will compel customers of non-conforming pits to testify against the offending pit operators.”

|

|

| Source: Reed Construction Data – CanaData. |

Steve Pegler of Calgary-based Elrus Aggregate Systems reports that 2009 was the company’s third best year in history, despite a 40 per cent drop in sales compared to the record “big spike” years of 2007 and 2008. In terms of regional markets, the Saskatchewan and Manitoba markets picked up during the year while Alberta has been slow. In Ontario, Elrus has grown into the mining sector in the Sudbury and Timmins areas with some operations running round the clock crushing ore, sampling and producing construction aggregates. Manufacturing output continues to be steady at Elrus’ original Calgary plant as well as the Aylmer, Ont., plant. In terms of product mix, business for crushers remains steady, while the big focus is on washing equipment, particularly in Quebec and Ontario.

Elrus continues its pattern of steady growth with the opening of a new 16,000 ft2 aftermarket and equipment sales facility in the Port Kells Industrial Park, Surrey, B.C., in June, 2009. In addition, the company is set to further expand with the opening of an additional branch in spring 2010, with Winnipeg and Saskatoon on the list of possible locations.

Looking into 2010, Pegler sees some encouraging indicators, one of which is an increase in the number of quotes for 2010 at the end of 2009. Overall, Pegler expects the first quarter of 2010 to be slow followed by a pickup in the second quarter, driven in Alberta by a combination of increased building permits and ring road construction.

|

As with many equipment manufacturers, Elrus’ sales volumes are influenced by the fortunes of the cement and oil business, with the latter a factor in the company’s Alberta home base. In the oil sands market, Pegler notes that a number of projects are on hold, with decisions to go ahead in turn influenced by the world price of crude oil. Turning to cement, Pegler finds that the capital funds for special projects such as a large conveyor project in Calgary are still being made available, in spite of the much publicized debt reduction measures being implemented by the cement companies. At the same time, the larger contractors are seeing work opportunities, with the construction sector staying relatively balanced across Canada compared to the volatile manufacturing and oil sectors.

Mormak Equipment Ltd. is a Vernon, B.C. – based designer and manufacturer of rock crushers and aggregate equipment. Mormak’s Bob Mohr reports a strong first half in 2009 was followed by a weaker second half, with the year’s overall sales of some $27million down about 15 per cent compared to 2008. Portable spreads still make up the majority of sales, supplemented by stationary installations such as the one recently completed for Island Asphalt in Duncan on Vancouver Island. Mohr has found the price of processing and mobile equipment at auctions to be a good indicator of industry activity and noticed some recovery in auction prices in the last quarter of 2009. Contract crushing prices, another indicator that Mohr tracks, have been variable in Mormak’s markets. In B.C., prices have held up reasonably well while prices in a soft Alberta market remain competitive. Further east in Saskatchewan, the market remains “pretty good.” Overall, the approach by many producers is to hunker down, though Mohr feels that the balance between supply and demand is significantly better in Canadian regional markets compared to the current overcapacity in some western U.S. markets. To illustrate the point, Mohr describes a recent visit to Portland, Ore., where one ready mix producer had no less than 40 ready mix trucks parked at 3:30 p.m. on a weekday afternoon.

|

At the operational level, 2009 has been steady and Mohr does not anticipate any significant operational issues in the upcoming year. On the all important people side, good people are being retained, while the number of people seeking work remains high, with three job applications being received on average each week. In terms of sales, Mohr predicts that 2010 volumes will be similar to 2009, with the number of highway jobs being called enough to sustain regional markets.

Jim Allard of Coquitlam, B.C.-based Allard Contractors Ltd. can be relied upon for a forthright viewpoint and describes 2009 as “terrible,” with concrete volumes some 50 per cent lower than in 2008. Moreover, those reduced volumes were typically secured at lower margins as a result of significant over capacity in the ready mix concrete market. Allard’s estimators have also been casting the net as far as North Vancouver and Vancouver, whereas in previous years there were sufficient volumes available in the company’s local Coquitlam market. The resulting longer hauls have put further pressure on margins due to the higher cost of fuel per cubic metre of concrete delivered as well as reduced volumes hauled by each truck.

On a brighter note, the opening of the Pitt River Bridge and the Golden Ears Bridge have significantly improved road communications across the Fraser River and provide new commuter connections between potential areas of commercial and residential construction. These two river crossings will be joined in a few years by the new 10-lane Port Mann Bridge as the central feature of the $2.46 billion Port Mann / Highway 1 Project. The job has already had its share of industry publicity, centring on the night time supply of materials to the job site. Special permits have been sought at the provincial level to supply the site’s 24-hour activity, although the granting of these permits has been controversial among residents living near the operations or site truck routes. Abbotsford Council has issued permits to a number of suppliers, and, according to the Council, the Port Mann Bridge project will consume some two million cubic metres of aggregates (over 3.5 million tonnes), of which about half will be supplied by Abbotsford rock quarries and gravel pits.

|

Major infrastructure projects aside, Allard is looking for an improvement in the residential sector market in 2010, as it is residential construction, particularly the single family home developments, that have traditionally provided the company’s core volumes. In this regard, Allard is fairly optimistic as the recovery in house prices should help. According to the Real Estate Board of Greater Vancouver, the year over price index for Coquitlam, as of November 2009, was 230.7 for detached properties compared to 216.5 for November 2008. Equivalent numbers for attached properties were 230.2 versus 213.1 and, for apartments, 247.4 versus 225.1. These indexes were averaged to 100 in the base year 2001.

Malcolm Matheson of Steed and Evans Limited, based in Kitchener, Ont., reports that 2009 was a surprising year overall and not the doom and gloom predicted in 2008. However, market sectors such as the sewer business were certainly well down while the reconstruction market was hit hard by the predicted increase in competition. With virtually no subdivision work, those players made forays into reconstruction market and absorbing a significant amount of work. The federal infrastructure program, together with all the matching funds, was the saviour for most of Steed & Evans’ work on the paving end, which in turn provided sales for aggregates. Still on aggregates, sales were down locally although, again, not as bad as predicted. Other markets that were more dependent on housing have, in Matheson’s view, suffered to a greater extent.

On the operational side of the business, asphalt cement (AC) prices followed the more typical seasonal curve of a higher spring start and progressed downward through season, with the improved price stability better for everyone compared to the price jolts of recent years. On the other hand, the U.S. dollar exchange rate against the Canadian dollar has been volatile, making 2009 a difficult year for those still buying equipment to match the timing of purchases with a favourable exchange rate.

The regulatory framework never seems to get easier, says Matheson. For instance, the new Species at Risk legislation is now in place, so all producers must survey their property for species. At the local level, Steed & Evans is also dealing with groundwater for drinking water supply and potential impacts of aggregate operations, as well as dealing with townships on licensing issues.

|

|

| The new 10-lane cable stayed Port Mann Bridge is scheduled to be operational in December 2012, with project completion in 2013.

|

A new wrinkle in the highway maintenance business is competition from offshore and south of the border. For example, an Australian company is now doing a Performance-Based Area Maintenance Contract (AMC) and bids are regularly being received from U.S. companies as well as a large multinational engineering management company. It is clear that nothing stays static in this industry, says Matheson, and, looking into the future, the main concern is not 2010 but 2011. It appears that infrastructure funding will help for 2010, but in Matheson’s view the private sector will not have recovered enough by 2011 to pick up the slack left from the dropoff in federal and provincial monies currently driving the road construction sector. Matheson is also concerned that there could be a pull back on existing commitments at both provincial and municipal / local levels as debt and deficits balloon. Delay tactics have been used in the past to defer expenditures, and it is hoped that exceptionally short sighted view doesn’t happen again: “We have a huge hole in infrastructure deficit to climb our way out of and the stimulus packages out now, while helpful, only provide a few small steps out of that hole.”

Ken Lucyshyn of Walker Industries Holdings Inc., reports that 2009 was budgeted to be weaker than 2008, although it took until the end of 2009 when strong performances in November and December brought actual numbers close to budget. Overall, 2009 landed between 15 per cent and 20 per cent behind 2008.

Lucyshyn explains that Walker serves two distinct Ontario markets; its original base in the Niagara region and the separate Simcoe County market in the Collingwood area, served by the company’s Georgian Aggregates subsidiary. Both these markets were impacted negatively during 2009, but in different ways.

In Niagara, a flat market was subject to further competition by the new market player, while the U.S. slowdown, a strong Canadian dollar and border delays combined to keep downward pressure on commercial and residential construction activity as well as tourist volumes to Niagara Falls.

Simcoe County on the other hand, has enjoyed huge growth over the previous five years, largely driven by private commercial and residential work. However, this activity came to a “grinding halt” in 2009. One of the frustrations, says Lucyshyn, has been the slow pace at which infrastructure stimulus funding has become available, both here and elsewhere. Even then, the funds that have been released seemed to have been mostly absorbed by consultancy and design work and, in Lucyshyn’ s view, misdirected towards low priority projects such as “scoreboards and park benches.”

For 2010, Lucyshyn expects overall business volumes to remain flat compared to 2009, with the new year seeing a reasonable start and volumes picking up in the third and fourth quarters. When it comes to capital expenditures on equipment, Walker will certainly be watching cash flow carefully throughout the upcoming year, but also expects to take advantage of the good deals that are available in the current buyer’s market.

On the sales side, Lucyshyn expects competition to remain strong, particularly in the Simcoe County market. Here, recent work has seen “twice as many bidders” as in previous years, with the competition including some paving and material supply contractors based in Toronto who are aggressively bidding work as far away as Collingwood.

On the operational side, costs continue to rise from, among other things, labour contracts with locked in wage increases. Walker will seek to pass these costs on by way of price increases, but Lucyshyn is not anticipating a warm reception from customers in a soft market with increased competition.

Still on operations, the increasing regulatory burden and a lack of overall co-ordination between the regulatory agencies are ongoing concerns. Walker’s operations are impacted by several regulators, including provincial ministries, local municipalities, the Oak Ridges Moraine and the Niagara Escarpment Commission. Each of these agencies has its own mandate and the rate at which new regulations come into force shows no sign of slowing. In Lucyshyn’s view, individual agencies are too focused on their own areas of jurisdiction and not recognizing the layered effect of multiple regulations from different regulators. As a result, the process of complying with existing and new regulations has become an unnecessarily time-consuming and expensive task that requires significant internal resources.

Martin Bouvier is a project manager for DJL Technologies, part of the Boucherville, Que.-based DJL group. Bouvier explains that DJL Technologies’ current market consists of Quebec, together with a presence in New Brunswick through the company’s Moncton Construction subsidiary.

Commenting on trends in road building and repair, Bouvier sees increased interest in road rehabilitation technologies such as cold in place recycling (CIR), hot in place recycling (HIR) and micro-surfacing. Other approaches are also gaining attention, particularly in smaller communities where lower cost solutions are essential for road maintenance departments with slim budgets. For example, a chip seal and micro-surfacing combination is only 19 mm to 26 mm thick in total, depending on the choice of aggregates, but is nonetheless proving durable on low volume roads with occasional truck traffic.

Bouvier is also seeing increased interest in Leadership in Energy and Environmental Design (LEED) projects utilizing new designs to reduce the environmental impact of asphalt construction. These include designs to reduce the heat absorption associated with black asphalt such as coloured asphalt and exposed aggregate finishes, often utilizing white aggregates. Other LEED applications use techniques to seal pavements and provide a watertight surface. These designs typically incorporate a catch basin, allowing the captured water to be treated if necessary prior to its discharge into the storm sewer system.

Looking forward to 2010, Bouvier’s contacts are indicating that Quebec’s 2010 annual highway budget should remain similar to 2009, while in New Brunswick the highway budget will rise to a third straight record $439 million for the fiscal year 2010/2011 following the $386 million budget of 2009/2010. In addition, New Brunswick should see extra work for the Public Private Partnership (P3) project for the St. Andrews to Saint John Highway. This is a 230 km long four lane stretch from Moncton to St. Stephen of which 55 km is new highway and the rest will be rehabilitated.

Terry Hughes, Paving Engineer with the New Brunswick Department of Transportation (NBDOT) reports that 2009 saw the placement of 780,000 tonnes of hot mix asphalt on NBDOT contracts compared to 770,000 tonnes in 2008, 350,000 tonnes in 2007 and 620,000 tonnes in 2006. The annual record is still held by 1997 with 1,200,000 tonnes placed that year.

In 2009, just over half (55 per cent) of the paving program was completed using End Result Specifications while 45 per cent used Method Specifications. The utilization of warm mix technology was higher in New Brunswick than in many provinces, totalling 56,000 tonnes (7 per cent) of the program and including Evotherm (5.4 per cent) and Hypertherm (1.6 per cent). Some 440,000 m2 of partial depth recycling was completed last year, of which 135,000 m2 was completed using foamed asphalt and 305,000 m2 used emulsion. 2009 also saw the completion of 100,000 m2 of full depth recycling, including the first ever paver laid project. Some 65,000 tonnes of recycled base asphalt mix was placed containing 35 per cent RAP, while about 22 per cent of all base asphalt placed consisted of recycle mixes. Additional technologies used included 100,000 m2 of micro-surfacing and 4,300 tonnes of Stone Mastic Asphalt (SMA). Hughes adds that the NBDOT is only using SMA for special high load situations such as climbing lanes, signalized intersections or high volume locations with slow moving traffic.

There were quality issues in 2009, such as the dust balls that appeared in the finished mat on several contracts. The reasons are not certain at this point, but the indications are that the dust balls were a result of high aggregate stockpile moisture contents caused by the weather during last spring and fall.

Like other provinces, the average age of New Brunswick’s construction workforce continues to rise and is an issue of increasing concern for both NBDOT and contractors. To combat this trend, NBDOT has been hiring technical school graduates over the past few years and there is ongoing training to ensure that the recent arrivals will be ready to replace retiring employees. In addition, the New Brunswick Road Builders & Heavy Construction Association (NB RBHCA) has established a training program with the New Brunswick Community College. This program gives operators a good foundation on operating paving equipment and now needs to be supplemented with actual on the job experience.

For 2010, Hughes expects the overall tonnage placed on NBDOT contracts in 2010 to be similar to 2009, with a planned slight increase in the percentage of warm mix asphalt. 2010 will also see the implementation of several major specification changes. These include a two year warranty on longitudinal joints as well as the mandatory use of a Material Transfer Vehicle on all contracts exceeding 5,000 tonnes on arterial roads and collectors. In addition, the department is planning to tender two contracts this year using End Result Specifications for contracts less than 8,000 tonnes.

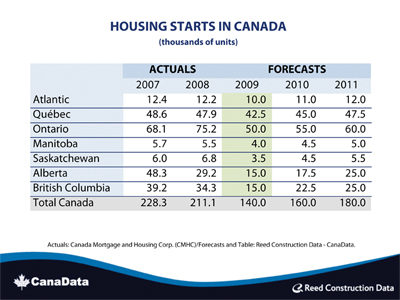

Patricia Arsenault, of Toronto based Altus Group Economic Consulting, says the outlook for housing starts in Canada in 2010 is for an improvement from 2009, but the degree is uncertain. Total housing starts Canada-wide for 2009 are estimated at about 145,000 units, and Altus Group expects that number to improve to the 150,000-160,000 range in 2010 (this compares to the 200,000+ levels that prevailed in the 2002-2008 period). The return of positive economic growth is encouraging, and the strength in existing home sales in 2009 (boosted by the extremely low interest rates) means that undersupply in the resale sector will steer increasing numbers of buyers to the new home market. However, there are a number of factors which are likely to temper the potential upturn in housing starts in most regions in 2010, including muted job growth, the likelihood of higher mortgage rates later in the year, and overbuilding in the condominium apartment sector in recent years. In B.C. and Ontario, the anticipated introduction of the HST in mid year will likely shift some housing starts forward into the first half of the year, with a weaker second half.

Print this page