Features

Columns

Education

We won’t get fooled

The biggest lesson for investors in 2014

April 17, 2015 By Jim Sanderson

Even the savviest (and I believe the relatively few) investors who make a living by timing the markets were fooled in 2014.

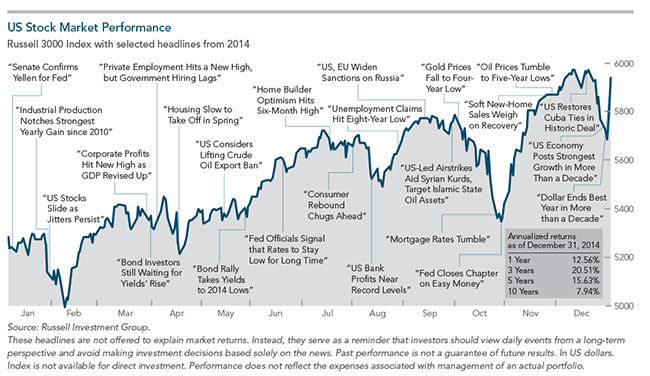

Even the savviest (and I believe the relatively few) investors who make a living by timing the markets were fooled in 2014. As stocks went up, there were some fearful moments for many investors that included the decline in oil prices and geopolitical and economic unrest. This resulted in a lot of second guessing and media suggestions to prepare for the worst. In the end, for the most part, it was a very good year.

|

|

It began with many analysts predicting a U.S. stock market return of between eight per cent and 10 per cent. In fact, the Standard & Poors (S&P) Index rose 11.39 per cent. Over the past 89 years, the Index and its predecessors have never delivered a total return between eight per cent and 10 per cent in any given calendar year – in every case it has been higher or lower. It was time “in” the market, which produced the annualized S&P 500 return of 9.32 per cent since 1929.

Fed belt-tightening uneases investors

Each year brings several dramatic events and 2014 was no different. The emotional intensity and frequency of market ups and downs increased during 2014 because many investors had become used to very low volatility experienced under the U.S. Federal Reserve’s (Fed’s) Quantitative Easing (QE) programs. As the Fed slowly exited the QE commitment and set the stage for an interest rate increase, investors feared the worst. Two previous Fed exits from QE rounds of easing caused the U.S. economy and markets to roll over and investors expected the third departure would have the same result. It did not because both were ready for QE’s jump from a stimulus platform that saw more than US$2 trillion funneled into the U.S. economy since 2008.

Investors buckled up for a rough ride as markets spluttered in January

A Wall Street Journal columnist warned in January: “The U.S. stock market is more overvalued than it was at the majority of the past century’s peaks.” Staying diversified and avoiding the futility of trying to frequently change exposure to stocks in an attempt to second-guess market forces and forecasting the future kept our clients on the right road again. Our asset allocation decisions involved investing our clients’ portfolios around their optimum asset mix and looking for opportunities to take profits or buy stocks when they were on sale. By being disciplined in our investing style, we did not get lured into the hype of the media.

Stock prices did indeed fall sharply in January, with the S&P 500 Index sliding 3.56 per cent and the Dow Jones Industrial Average dropping 5.30 per cent. Many analysts advised investors to buckle up for a rough ride.

Then, the turbulence ended and the ride got smoother as the S&P 500 Index rose over 19 per cent from Feb. 3 through Dec. 31. The U.S. economy also ended 2014 as a beacon for the rest of the world thanks to growing consumer confidence and business investment.

“I've had a lot of worries in my life, most of which never happened.” – Mark Twain

If we could measure collective investor anxiety, it would likely have reached its peak for the year in mid-October. On Oct. 15, the Dow Jones Industrial Average plunged as much as 460 points during the day before rallying to close with a loss of 173 points. At that point, the Dow was down 2.6 per cent for the year while the S&P 500 clung to a slim gain of 0.76 per cent. The selloff was front-page news the following day in the New York Times, which observed, “The party is over. Waves of nervous selling buffeted the stock market in the U.S. on Wednesday, after a steep sell-off in Europe… Since their peak a month ago, American stocks have lost over $2 trillion in value, losses that may ripple through the wider economy… The faltering global recovery after the 2008 financial crisis may now be in jeopardy, particularly in Europe.” Source: Peter Eavis and Landon Thomas Jr., “Steep Sell-Off Spreads Fear to Wall Street,” New York Times, Oct. 15, 2014.

More drama followed as investors again braced themselves for a continuing slide in stock prices that never occurred. They watched warily as momentum-driven hedge funds sold off, fears of a weakening global economy grew, and another reported U.S. case of the Ebola virus made world news. Nevertheless, year-to-date stock returns were back in the plus column the following day and kept rising through December.

Regardless of what pain the market watchers said was looming on the horizon at any point in time, diversification again proved to be a huge part of alleviating that pain in 2014. As Mark Twain wrote, “I've had a lot of worries in my life, most of which never happened.”

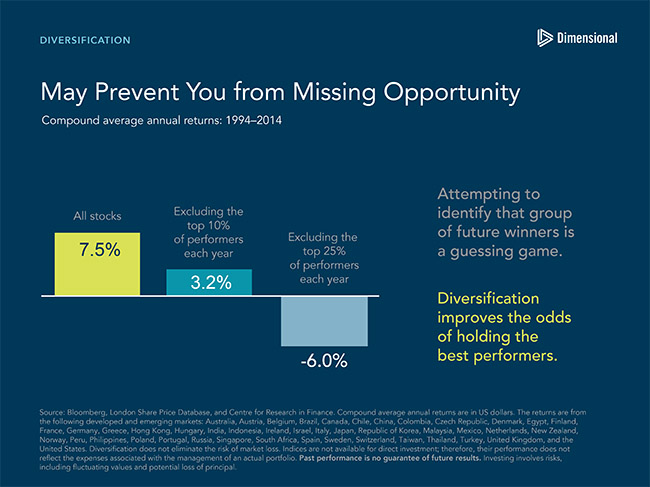

The year again proved that when it comes to positioning yourself to maximize market gains and minimize downturns, portfolio diversification continues to be one of the best strategies (Diagram 1).

Diversification: Risk management at its purest

Portfolio diversification is really risk management at its purest. This quote from Harry Markowitz, the Nobel Prize-winning father of what is now known as Modern Portfolio Theory (MPT), sums up the case for diversification: “Clairvoyant analysts have no need for diversification.” I don’t know about you, but I have yet to meet such a person. They seemed to exist in great numbers until the extreme technology sector correction in 2000/2001 provided some painful lessons. It proved that bull markets do not last forever, and highlighted one of the fundamental reasons behind the need for investors to diversify.

Diversification is really a way to reduce risk in your portfolio by choosing a mix of investments. A diversified investment portfolio set up to reflect each investor’s risk tolerance and investment goals usually consist of three key asset classes. These include:

- Cash – for maximum safety and liquidity

- Fixed income – safety, income and diversification of equity risk (equities and fixed-income products tend to move in opposite directions)

- Domestic and foreign equities – growth potential and capital gains

If you hold a diversified portfolio, it is unlikely that all of your investments will rise or fall at the same time. For example, stocks and bonds usually move in opposite directions – under normal market conditions.

The global stage lights flickered throughout 2014

Throughout 2014, the global economy continued to slowly expand, albeit at an uneven pace. As interest rates languished, economic headwinds led many investors to believe that rates would rise in 2014, at least in North America, and lift the fixed income asset class with them.

China’s waning economic fortunes unnerved many investors as growth in emerging markets dimmed. Oversupply in the energy market triggered a drop in oil prices and other commodities, which reverberated across global markets. A barrel of crude oil fell to below US$50 – its lowest level in six years. No one saw that one coming.

Canada’s S&P/TSX Composite Index fell 1.5 per cent over the fourth quarter, but gained 10.6 per cent over the year.

Further afield, the MSCI World Index, which measures large and mid-cap equities in 23 developed markets gained 5.5 per cent over the year in U.S. dollar terms. Among 45 developed and emerging markets tracked by MSCI, total return expressed in local currency ranged from 38.66 per cent in Israel to -31.59 per cent in Greece. Thirty-five non-U.S. markets had positive returns, including 17 with higher returns than the U.S. With so many pessimistic discussions of the European economy during the year, many well-diversified investors were heartened to learn that stocks in Belgium, Denmark, Finland, Ireland and Sweden outperformed U.S. stocks when expressed in local currency.

On the fixed-income front in 2014, the slow pace of economic growth meant that monetary policy remained focused on enabling growth. While the U.S. Federal Reserve Board ended the asset purchase programs it began in 2008, other central banks remained intent on keeping interest rates low, their currencies soft and their export markets competitive. Bonds did well as a result. The FTSE TMX Canada Universe Bond Index, which monitors Canadian government and investment-grade corporate bonds, grew 2.7 per cent in the fourth quarter and tallied a gain of nearly 8.8 per cent over 2014.

|

|

| Diversification improves the odds of holding the best performers.

|

“Texas tea” kept many investors up nights

Black gold. Texas tea. Oil prices took centre stage as 2014 wound down. While Canadian vehicle owners celebrated the weight of their wallets after what was formerly a dreaded trip to the pumps, the deep decline in oil prices was not so welcome within the Canadian equity market, in particular. While this was a negative development for many, it is important to remember that like asset classes, industry sectors and geographic markets seldom move in lock step, and diversification among these sectors can benefit an investment portfolio. Falling oil prices, for example, can lift other sectors and drive consumer spending and help reduce costs borne by transportation companies and by manufacturing and related industries. As certain sectors benefited, the global energy industry ended the year by taking a hard look at the viability of their operations. Russia remained in crisis after the hugely energy-reliant and unpredictable superpower was blind-sided by the damaging (50 per cent) devaluation of its currency. Yet, in the spirit of prudent diversification, the energy sector still held a place in the equity portfolios of many investors.

As an investment professional, I have learned to take the long view, which means focusing first on ensuring your long-term financial well-being, even as the world seems to reverberate from one shock after another. I can’t predict the future. I have tried and was unsuccessful. I use my mental energy to prepare and respond to what we can control – asset allocation and diversification – rather than to second-guess the timing of the next event. Advisors help keep your emotions in check which might be the greatest determinant of success. And, to remain invested… and diversified.

Jim Sanderson is a senior wealth advisor with over 28 years in the investment services industry. The Jim Sanderson Group at ScotiaMcLeod specializes in creating and distributing wealth for successful individuals and corporations in the aggregate and road building industries across Canada. He helps his clients supported by a team of experts in insurance, merchant banking, trust and estates. Jim can be reached at jim.sanderson@scotiamcleod.com. Call at (416) 945-4844 or visit his website at jimsandersongroup.com.

Print this page