Features

Columns

Education

Strategies for Succession

According to the Canadian Federation of Independent Business, only one-third of Canadian businesses

February 14, 2012 By Jim Sanderson

I wrote this article to help business owners maximize the financial

benefits a well-thought-out and well-executed business succession plan

can create for them and their families.

I wrote this article to help business owners maximize the financial benefits a well-thought-out and well-executed business succession plan can create for them and their families. This may involve passing the business to the next generation or selling it to a third party. Regardless of the business owners’ situation, they have only two options: to sell when they want with a plan, or not.

It is critical to state the obvious up front: You, the business owner, want the process to reflect your goals and objectives. The succession strategy must flow from here.

In addition to maximizing the after-tax value generated by the succession plan, other goals may include preserving the family/business legacy, ensuring discretion and fairness, and making the transition a smooth one.

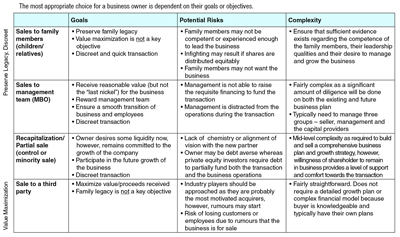

There are four succession strategies you may wish to consider:

1. Sale to family members

When choosing this option, your goals may include preserving the family legacy, ensuring a discreet and quick transaction and being more focused on the quality of the transaction for all parties than on the value you derive from it.

Risks may be involved. For example, family members may not be experienced enough to lead the business; infighting may result from inequitable share distribution; or some family members may not want the responsibility of taking over the business.

If you are going to keep the business within the family, you need to be sure that your successors are competent, and have the desire and leadership qualities to be successful.

2. Sale to your management team

Your driving goals here are to get fair value for your business; to reward the management team; and to ensure a smooth transition of business and employees, and a discreet transaction. Risks you face include management not being able to raise the money to fund the transaction or management becoming distracted from running the business as the transaction details are negotiated. This can be a complex process as both the present and future business plan will come under close scrutiny by the prospective financial backers. You also need to manage three entities – the seller, management and capital providers.

3. Recapitalization/partial sale to keep you in the game

You may require liquidity now to address personal needs while maintaining a strong belief in the future growth of the business. Many business owners believe that the only option here is to sell but a recapitalization of the balance sheet can provide short-term personal capital while allowing you to partner with a deep-pocketed investor to help the business to the next level of growth.

Trouble may occur due to a lack of shared vision or chemistry with the new partner; or your reluctance to take on debt, which private equity investors require to partially fund the transaction and the business. This can be a complex process, as a detailed business plan and growth strategy will need to be built to withstand significant scrutiny. Your willingness to remain in business, however, will provide credibility and help the transaction go smoothly.

4. Sale to a third party

If you sell outside the family, you will want to maximize the value and proceeds you receive. Maintaining a family legacy will not be an issue, although owners who sell long-established family businesses clearly want their brand to remain positive in the hearts and minds of their many loyal and valued customers. While industry players are probably the most motivated purchasers, they could weaken your position should rumours start flying. You may also run the risk of losing employees and customers once word is out that the business is being sold.

This need not be a complex process, as the buyer is usually knowledgeable about the industry and will have its own plans to implement in taking the business forward.

Regardless of the option you choose, ensure you have experienced advisors to help mitigate your risks.

Not Necessarily All or Nothing

Your changing role need not be an all-or-nothing proposition. Methods of selling your business to the next generation or a third party are fairly well known. management-led buyouts (MBOs) and recapitalizations tend to be less familiar.

Here are two case histories to illustrate both options.

1. Management-led buyout

Situation: The family owned the business and has been running it since the early 1900s. It is a major employer in several rural communities. The husband and wife (the founders) transferred ownership to two sons who have key leadership roles in the business.

The sons are now in their 70s and transferred much of their operating responsibility to key management. These employees had an average of 20 years’ service and saw growth opportunities for the business.

The owners had three goals: to receive 100% liquidity; to preserve the business culture and jobs; and to reward management for their efforts.

Solution: A management-led buyout was recommended in order to: continue the longstanding legacy; ensure a smooth and discreet transition of ownership; align with deep-pocketed partners to pursue growth opportunities and share risk.

The advisor and his experts set out these steps: assigning a reasonable price to the business; identifying the amount of capital management should invest and the resulting ownership ratio and equity dilution; creating an appropriate capital structure; bringing the financing to market; closing the deal.

How it transpired: Several challenges existed. The company’s historical growth had been stagnant owing to the owners’ wish to divert company cash flow to dividend creation versus reinvesting it in the business. Management was consulted to ensure their growth strategy would be viable in the eyes of investors. They also had concerns over having a “Bay Street” equity partner.

Ultimately, both private equity investors and banks showed great interest. The transaction allowed the owners to exit fully and management received an additional equity boost to realize the growth plan.

New capital was also injected into the business to execute the growth plan.

2. Recapitalization

Situation: The founder, who was in his mid-50s, required liquidity for estate planning purposes. He was under the initial impression he had to sell 100% of his business to achieve this goal. He saw significant business growth potential but was not prepared to put more of his capital at risk. He was the majority shareholder among a group consisting of several employees.

His business was generating strong sales growth and produced healthy EBITDA margins. The prospects for the business were good and enjoyed steadily increasing market share. It had also carved out a small but growing niche in the U.S. and had many acquisition opportunities.

Solution: The advisor recommended that a business recapitalization would better meet the founder’s objectives than a sale. The shareholders were advised with the help of his experts through the recapitalization process, which included valuation of the business; pros and cons of liquidity alternatives; appropriate capital structure; introducing the company to the financial market; and closing the deal.

How it transpired: Initial challenges included satisfying investors and lenders that key individuals were not leaving the business; finding an equity partner with whom the owner and management could work effectively and who had the necessary experience to add value; getting management comfortable with the idea of taking on an equity partner and operating with more debt.

The opportunity generated tremendous investor and lender interest. The shareholders withdrew virtually all of the equity in the business but retained a disproportionately high level of ownership. The partnership jelled and led to several strategic acquisitions as the business grew.

Sleep Well by Creating Long-term Cash Flow Outside the Business

It is important to understand the value of a creating an investment portfolio long before you leave or sell the business as another source of cash flow.

By setting up an investment portfolio well in advance of making any business succession or sale decisions, you are planting the seeds for a potentially prosperous future, as your financial needs change with your lifestyle requirements.

Creating an investment portfolio is also an excellent way to get comfortable with diversifying your investments versus focusing on one money generator – your business.

Please see my articles on diversification and risk reduction and how to identify the right financial advisor (Aggregates & Roadbuilding Magazine Sept/October 2011 issue) and “The Value of Professional Advice” (May/June 2011 issue).

For easy access, visit my website at www.jimsandersongroup.com.

|

Jim Sanderson is a wealth advisor with 25 years in the investment services industry. The Jim Sanderson Group at ScotiaMcLeod specializes in creating and distributing wealth for successful individuals and companies in the aggregate and roadbuilding industries across Canada. He helps his clients supported by a team of experts in insurance, merchant banking, trusts and estates.

Print this page